Investment to Accelerate Company’s Next Phase of Growth in Large and Expanding Supply Chain Management Market

Atlanta, GA and Boston, MA – September 21, 2021 – Blue Ridge, the leading supply chain planning and price optimization platform combining break-through demand sensing and shaping, today announced a strategic investment from Great Hill Partners, a private equity firm that invests in high-growth, disruptive companies. Great Hill’s investment will support Blue Ridge’s ongoing efforts to capture more of the large and expanding market for supply chain management software in the U.S. and Europe by accelerating growth across its core verticals, as well as developing additional tools and modules to help further address customer needs. Financial terms of the transaction were not disclosed.

Blue Ridge uniquely blends the disciplines of supply chain planning and pricing together under a fully configurable cloud-based platform. The Blue Ridge platform uses AI and Machine Learning to accurately forecast demand and intelligently position inventory to capture sales and reduce costs, while optimizing pricing to maximize profit for distributors, retailers and manufacturers. With a sizable core addressable market and significant runway for future growth, Blue Ridge is well-positioned to capitalize on the large and growing $34 billion supply chain management ecosystem.

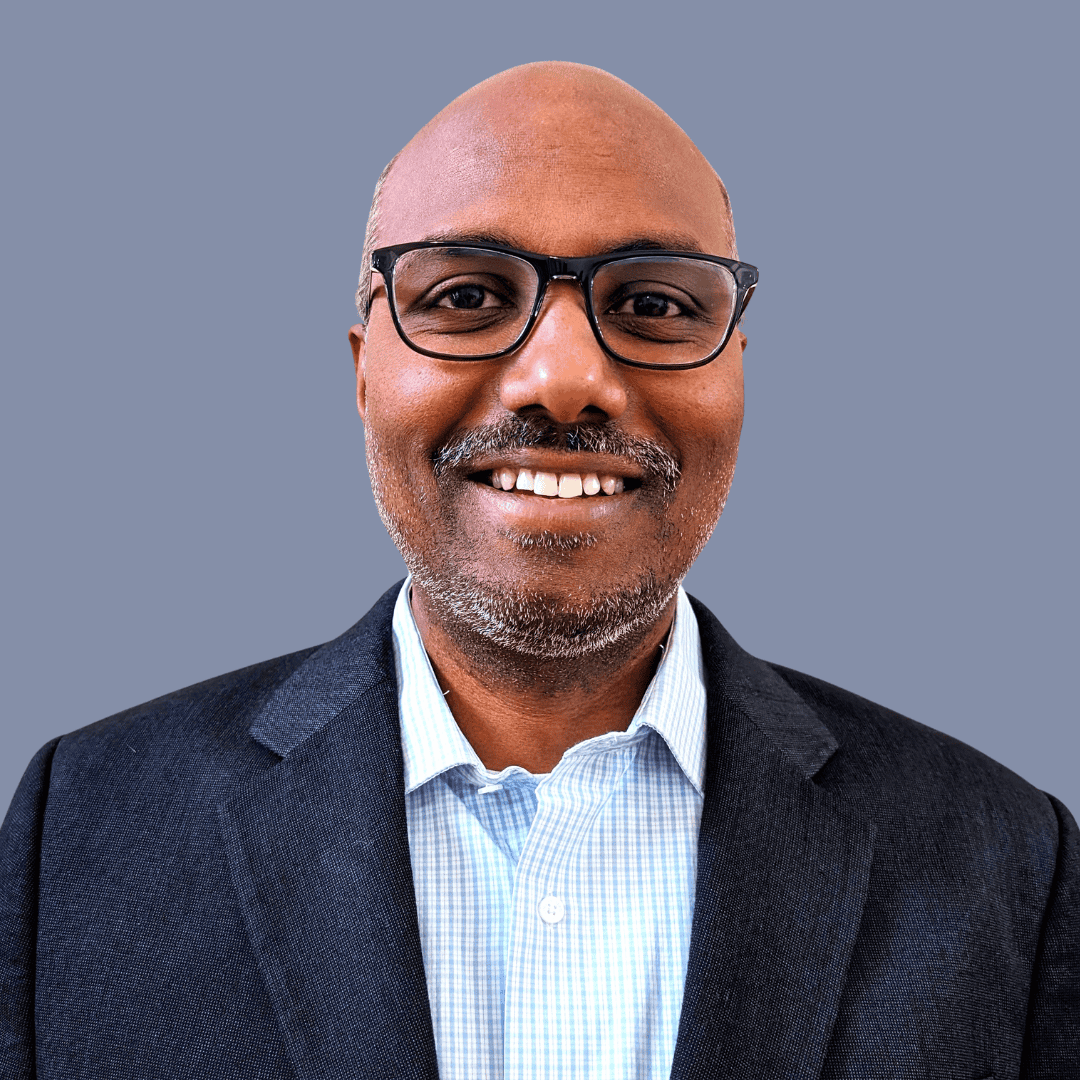

“Since our founding, Blue Ridge has aimed to create a transparent connection between inventory and pricing, helping customers make informed decisions while lowering risk, maximizing profits and improving agility,” said Blue Ridge Chief Executive Officer Jim Byrnes. “With Great Hill’s investment, we will be able to further penetrate our rapidly growing market and partner with more customers who are demanding our unique capabilities and solutions to manage their supply chains, optimize pricing and drive significant cost savings. We believe Great Hill’s experience partnering with innovative software companies like Blue Ridge is critical for our next stage of growth.”

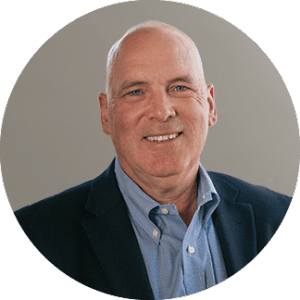

“Supply chain software continues to see high demand, particularly in the current environment where retailers, distributors and manufacturers are looking for every opportunity to grow profits, and we believe Blue Ridge is best-positioned to take advantage of this tremendous market opportunity,” said Matt Vettel, a Managing Director at Great Hill Partners. “Blue Ridge offers a unique approach, seamless user experience, differentiated customer support and fast implementations – making it an essential partner to its diversified customer base. We are thrilled to partner with Jim and the entire team to help bring the company into its next stage of growth.”

As part of the transaction, representatives from Great Hill, including Matt Vettel, Nick Cayer, Bob Anderson and Tucker Albert, will join the Blue Ridge Board of Directors. In addition to Blue Ridge, Great Hill’s portfolio of software companies includes: eloomi, VersaPay, Jumio, Auvik and Intapp, among several others.

Lightning Partners served as financial advisor to Blue Ridge and Vocap Partners, the former majority shareholder in the company.

About Blue Ridge

Achieving a resilient supply chain sits at the intersection of demand, price, and inventory – where a company’s customers, suppliers, and their operations meet. Blue Ridge’s cloud-native planning and pricing platform gives distributors, retailers and manufacturers app simplicity that uniquely integrates data science-rich inventory forecasting capabilities with price optimization insights. From modeling, right-sizing inventory, and seamless collaboration, Blue Ridge bases success off increases in customer profitability and service levels. Learn more at https://blueridgeglobal.com or request a demo at https://blueridgeglobal.com/request-demo/.

About Great Hill Partners

Great Hill Partners is a Boston-based private equity firm targeting investments of $25 million to $500 million in high-growth companies across the software, digital commerce, financial technology, healthcare, and digital infrastructure sectors. Over the past two decades, Great Hill has raised nearly $8 billion of commitments and invested in more than 75 companies, establishing an extensive track record of building long-term partnerships with entrepreneurs and providing flexible resources to help middle-market companies scale. For more information, including a list of all Great Hill investments, visit www.greathillpartners.com.